Bitcoin (BTC)

Bitcoin is currently trading at $58,162.98, experiencing a slight decline of 0.72% over the past 24 hours and showing a 7-day drop of 5.36%. The recent fluctuations are attributed to macroeconomic factors, including changes in market liquidity and significant events like the anticipated Mt. Gox refunds. Despite the current dip, analysts maintain a bullish outlook for Bitcoin, predicting it could potentially reach up to $90,000 by the end of the year due to ongoing institutional adoption and advancements in layer 2 technologies.

Ethereum (ETH)

Ethereum is priced at $3,134.84, down 0.19% in the last 24 hours and showing an 8.94% decline over the past week. The market dynamics are influenced by upcoming events such as the possible launch of spot ETFs on Ethereum, which could significantly boost its price. Ethereum’s recent performance has been impacted by overall market trends, but it remains poised for potential growth with predictions suggesting it could range between $3,100 and $4,500 in the near future.

Regulatory Developments

In a significant regulatory move, Cuba has recognized cryptocurrencies, citing socioeconomic interests. This new resolution mandates that companies offering crypto-related services obtain a license from the central bank, indicating a step towards greater regulatory clarity and potential mainstream adoption.

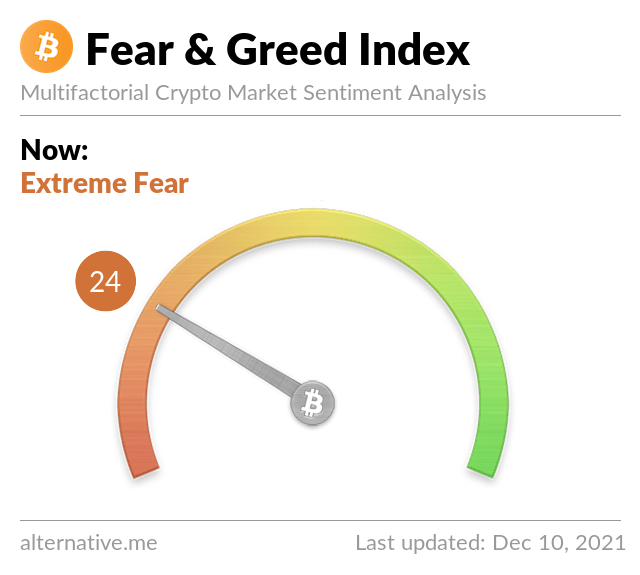

Market Sentiment and Predictions

Historically, September has been a challenging month for cryptocurrencies, often showing limited gains or losses. However, the current market sentiment driven by macroeconomic factors and key regulatory developments could pave the way for a more bullish trend towards the end of the year.

Expert Predictions:

Anthony Scaramucci: Remains optimistic about Bitcoin, maintaining his prediction of BTC reaching $100,000 by the end of 2024 due to its fixed supply and growing demand.

Curtis Sliwa: New York City mayoral candidate, emphasizes making NYC a crypto-friendly city by increasing crypto ATMs and incentivizing businesses to accept cryptocurrency payments.

Conclusion

The crypto market continues to evolve with significant regulatory changes and market dynamics. Investors are advised to stay informed and exercise caution, avoiding leverage and making wise investment choices.

Stay tuned for more updates, and let's see where this exciting journey takes us next!